Kazakhstan offers a distinctive lifestyle at a somewhat low cost of living. The nation provides a variety of alternatives to fit a range of budgets, from lodging and transportation to dining and entertainment. Comprehending the cost of living in Kazakhstan facilitates financial planning and decision-making for both locals and foreigners about living expenses, healthcare, schooling, and other necessities.

This article examines the many facets of living in Kazakhstan, such as its lifestyle, cultural highlights, and a thorough analysis of the cost of living there.

Navigating expenses

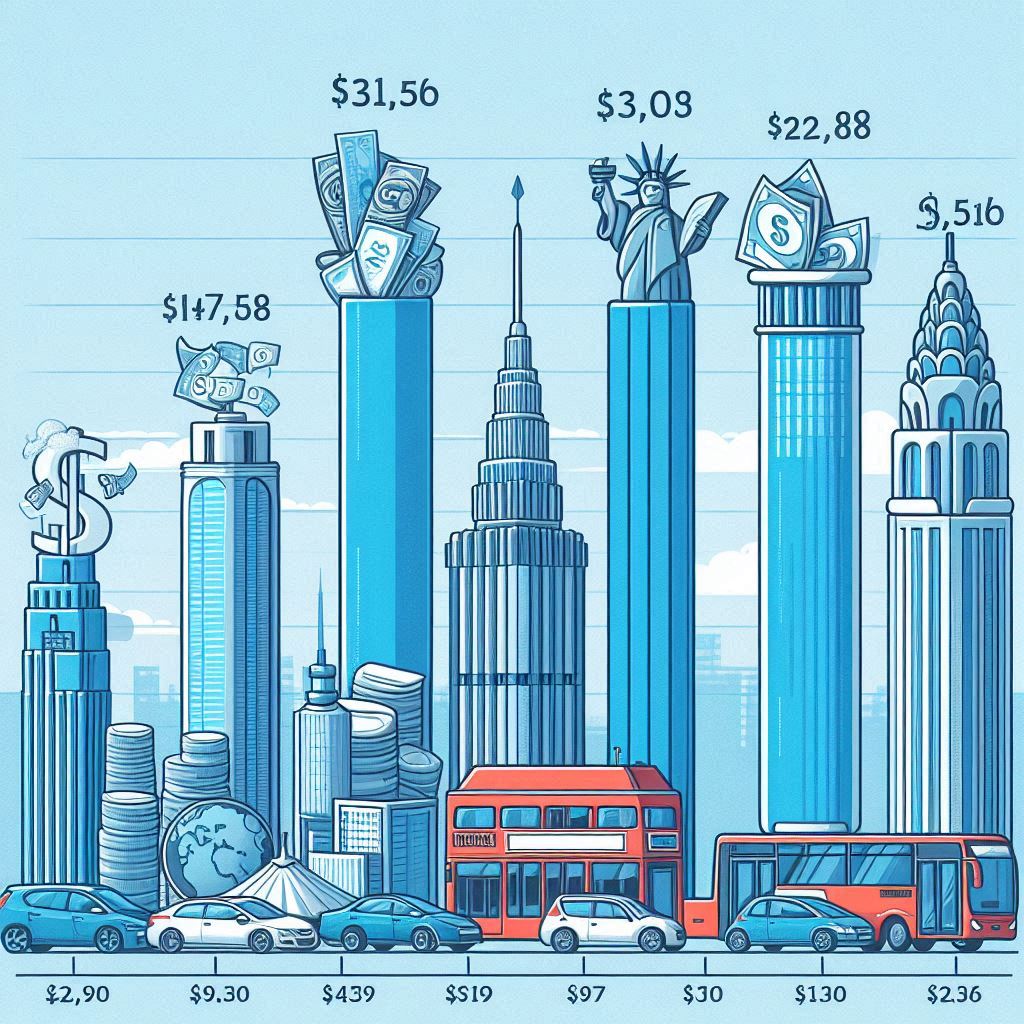

Kazakhstan is renowned for having a very low cost of living, particularly when compared to other nations. The seven main components of Kazakhstan’s cost of living are listed below:

- Accommodation

The location and kind of housing have an impact on the cost of lodging in the country. It can be more expensive to rent an apartment in the city centre of large cities like Nur-Sultan (previously Astana) and Almaty than in the suburbs. While comparable apartments outside of the city centre may cost between $250 and $500 per month, a one-bedroom apartment in the city centre may often cost between $400 and $700.

- Food and groceries

In general, food and supplies are reasonably priced in the country. A vast range of fresh fruit, meats, and dairy items are available at affordable costs in regional markets, convenience stores, and street markets. According to their dietary patterns and individual tastes, a household of four may spend $200 to $400 a month on groceries.

- Transportation

In Kazakhstan, public transit is reasonably priced and robust, especially in the larger cities. An individual bus or subway ticket typically costs between $0.30 and $0.50, making it reasonably priced. There are also taxis available; the cost varies based on the route and city. Popular taxi service firms like Yandex and Uber also provide reasonably priced transit choices.

- Healthcare

There are both public and privately owned healthcare institutions in the nation. Although residents and citizens can receive public healthcare, the quality of care may differ. greater quality care is offered by private healthcare, although the cost may be greater. It is recommended that foreign nationals have full coverage for medical insurance. In Kazakhstan, the monthly premium for private medical protection can vary from $50 to $150 based on the provider and policy.

- Utilities

In general, commodities such as heating, water, and power are reasonably priced in the nation. Given the region and consumption, monthly rates for a modest flat might vary from $50 to $100. It’s crucial to keep in mind that utility expenses could rise in the winter because of the need for heating.

- Education

Kazakhstan boasts an extensive educational system with several degrees of access to both public and private institutions. Private foreign educational institutions may have greater tuition costs than public ones. The monthly expenses for education in the country vary according to the curriculum, grade level, and institution. They might range from $500 to $1,500.

- Entertainment and recreation

Kazakhstan provides its citizens with a variety of leisure and entertainment options. The price of entertainment might vary based on geography and personal choices, such as eating out, seeing a movie, or going to a cultural event. In general, entertainment costs are not too high in Kazakhstan; a mid-range restaurant supper for two would run you between $20 and $50.

Understanding the taxes and financial obligations in Kazakhstan

Although the tax system in Kazakhstan is complicated, both people and businesses need to understand it. The income tax rate in the nation is progressive and ranges from 10% to 20%. High incomes are subject to extra levies. Additionally, it charges a 12% value-added tax, or VAT, on the majority of products and services. Individuals have until March 31st to file their yearly tax returns, while corporations have until April 30th to complete their financial duties. To prevent fines, it’s critical to maintain correct records and fulfil all reporting obligations. Businesses and individuals may support Kazakhstan’s economic growth by being aware of and meeting these tax duties.

To guarantee adherence to financial and tax requirements in the country, both individuals and companies have to contact certified accountants or tax advisors. These professionals can offer advice on tax preparation, documentation, and reporting needs. Additionally, since Kazakhstan’s tax code is subject to rewrites regularly, it is important to keep up with any changes to tax rules and regulations. Both people and companies can help Kazakhstan’s economy expand and remain stable by proactively handling their tax and financial commitments and avoiding fines.

You may also find these articles helpful

Cost of living in Denmark – full guide