A beautiful country in the Pacific Ocean, the Marshall Islands is home to white sand beaches, glistening waterways, and a lively culture. It’s important to comprehend the expense of living in the Marshall Islands since both visitors and foreigners are drawn to this isolated paradise. This thorough guide will serve as your compass whether you’re thinking about moving here or are just interested in learning more about life in this distinctive region of the world.

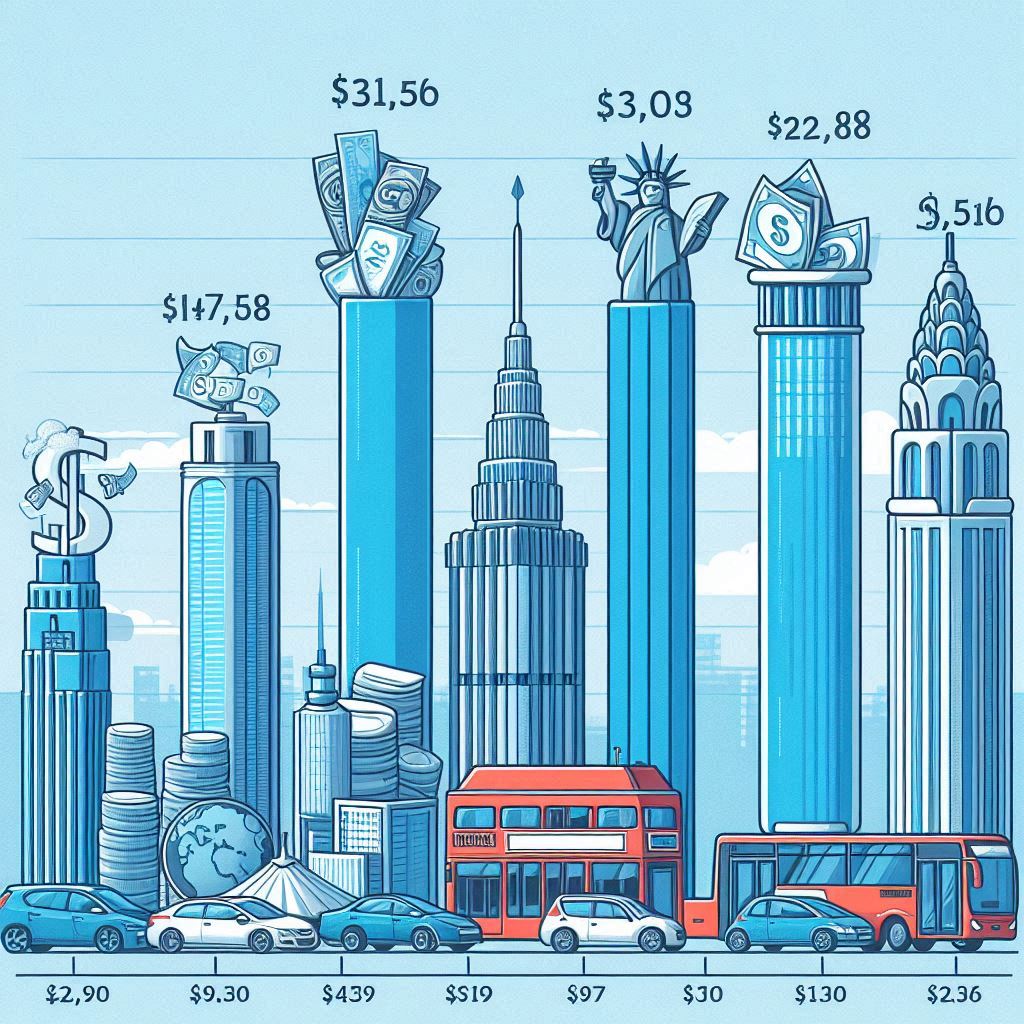

Accommodation costs

In the Marshall Islands, a vivid spectrum of housing options awaits, from luxurious beachfront estates to budget-friendly apartments. A well-located one-bedroom apartment typically ranges from $700 to $1,500 per month, accommodating various preferences and budgets. Examine nearby rentals and think about relocating away from popular tourist destinations to save money on lodging.

Costs of groceries and daily expenses

Because of the Marshall Islands’ isolated location, groceries can be somewhat expensive when it comes to daily spending. When compared to imported goods, local markets provide cheaper possibilities. The cost of eating out might vary from $5 for a quick lunch to $15 for a formal dining event.

Transportation costs

Within this nation, public transportation primarily relies on buses and taxis, offering convenient mobility. However, traveling between islands necessitates air travel, which can be more expensive, with inter-island flights ranging from $50 to $200, contingent upon the distance to your destination.

Healthcare and medical expenses

Although scarce, healthcare facilities provide essential services. Health insurance is essential and can range in price from $50 to $100 a month. Expatriates should save for possible medical bills as well as evacuation fees.

Educational costs

Both American and other curricula are offered by international schools. Various financial aid options are available, and tuition expenses exhibit significant disparities. Allocating funds for your children’s education is of paramount importance.

Financial and tax considerations

The tax system in this nation is simple. But it’s important to be aware of fluctuations in currency rates. When organizing your budget plan for the islands, take this into account.

Communication costs

An array of internet and mobile service providers grace the Marshall Islands. Mobile phone packages and internet bundles, catering to diverse needs, may span from $50 to $150 monthly. Maintain a steady stream of contact, but set aside money for it.

Utility and electricity

Water and electricity are necessities, yet their prices might change. Depending on your usage, monthly utility expenditures for a one-bedroom flat can range from $50 to $150. To control these costs, be aware of the energy you use.

Banking and financial services

In this country, banking and financial services are accessible. Recognize foreign banking fees, currency conversion rates, and the convenience of having a local bank account.

Import costs

Because of the nation’s isolated position, imports can be somewhat costly. Be ready for increased costs if you require certain products or have certain preferences. Choosing products that are made or supplied locally may help save costs.

Social and cultural activities

Participating in social and cultural events can enhance your trip to the country. You should account for the costs of recreational activities, club dues, and cultural events in your budget. Participating in the community can offer opportunities for personal development as well as insightful cultural perspectives.

Currency exchange

Stay vigilant on exchange rates, as they wield a profound influence on living costs, particularly if your savings or income involve foreign currency. Meticulous currency exchange planning is key to optimizing your budget.

Investments and savings

After you’ve set your basis financially, look into ways to invest and save money. To make your money work for you while you’re living on this island, you can think about investing in foreign currencies, savings accounts, or other financial products.

Social support

Make ties and create a support system with the local and foreign community. To successfully navigate the special opportunities and challenges of living in this nation, these relationships can offer insightful counsel, support, and assistance.

Emergency funds

Having an emergency fund is essential if you live in a remote area. Make sure you have funds set up for unforeseen bills, emergencies, and possible evacuation charges.

You may also find these articles helpful

Cost of living in Denmark – full guide